Decoding the Matrix: How African Founders and Investors Can Redesign Economic Freedom - My AfroTalks

The Cost of the Wrong Capital Game: How Ami Colé Won the Market but Lost the Business

From Hustle to Infrastructure: How African Unicorns Are Redefining Everyday Systems

This shift from hustle I also refer to as the ‘IRT factor’ to infrastructure signals the next chapter of Africa’s digital transformation. We have singled out these four companies, showing exactly how that evolution is playing out.

5 Tips for Investors in African Tech Markets

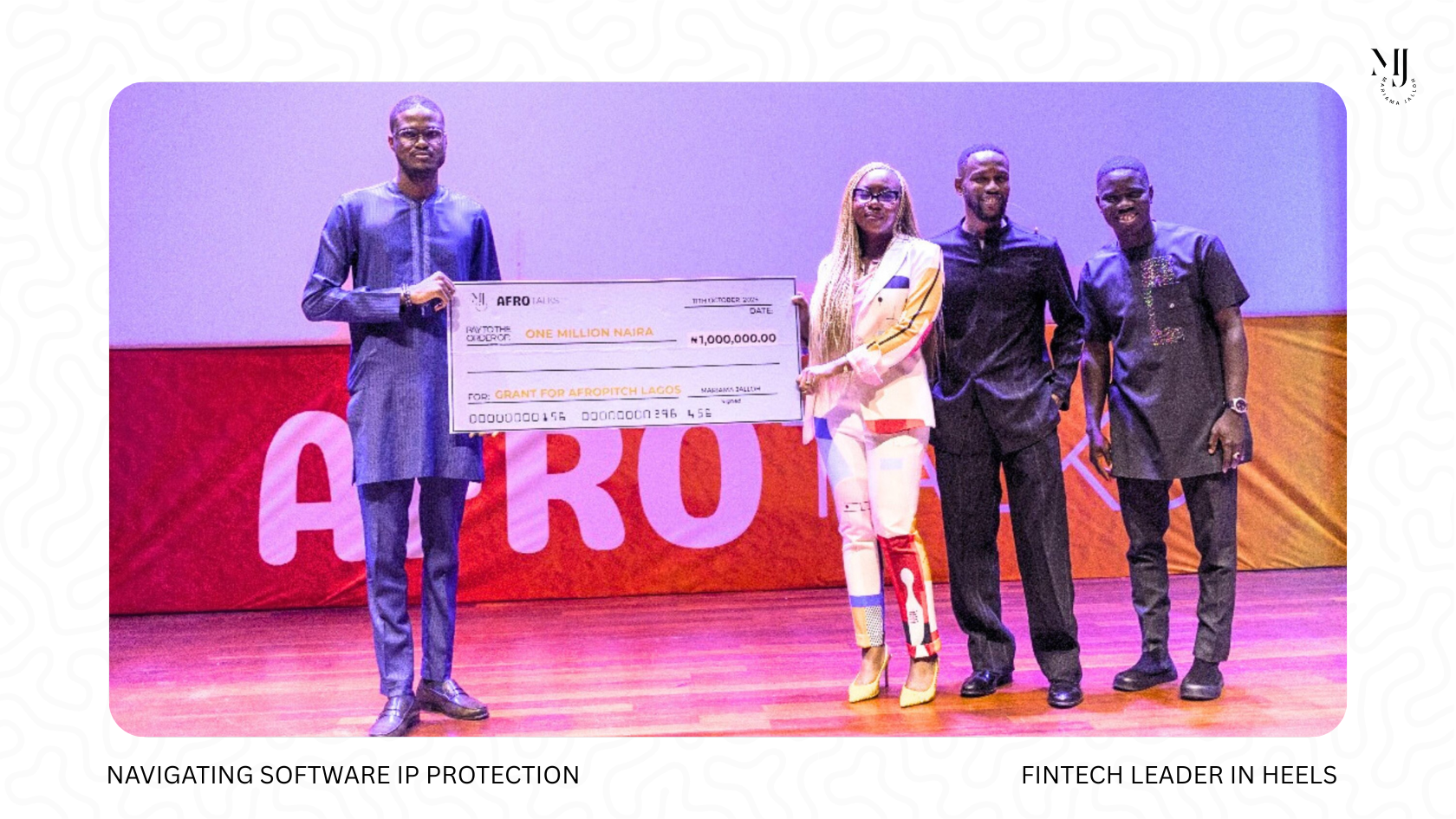

Uncharted Territory: Navigating Software IP Protection Across Africa’s Diverse Markets

Reducing ECOWAS Travel Costs: Lessons from the EU for Africa’s Free Movement Vision

Cross-Border Fintech Licensing: Can Africa Build Its Own ‘Fintech Passport’?

The IRT Factor: Why Ingenuity, Resilience, and Tenacity Define Founders in Emerging Markets

Across Africa, Latin America, and South Asia, founders aren’t building inside predictable systems they’re building in spite of them. And the entrepreneurs who thrive are powered by what I call The IRT Factor: Ingenuity. Resilience. Tenacity.

AI Is Transforming Industries but Is Africa Ready?

In Lagos, Accra, and Nairobi, homegrown machine learning labs are tackling real-world problems verifying identity without credit histories, predicting crop yields with satellite data, or creating AI-powered translation tools for indigenous languages.

Why Google Is Investing $37M into Africa

Bloomberg’s Africa Risk Map: What the Data Really Tells Us About the Continent’s Growth Story

When Bloomberg Economics released its latest Africa Risk Scorecard, it offered a rare, data-driven snapshot of how 19 African nations are performing across the fundamentals that matter most to investors. The analysis doesn’t just reveal who’s leading or lagging; it helps unpack where opportunity lives and what’s holding it back.

Africa Doesn’t Need Conquerors, It Needs Partners - My take on Bloomberg’s Investor’s Guide to Africa

The frontier framing implies that Africa is there to be discovered. In essence, it exists as a blank slate waiting for global investors to draw the blueprint but Africa isn’t uncharted; it’s undervalued. There are centuries of systems, skills, and structures that continue to evolve even when they don’t fit Western investment models.

Africa’s Next Fintech Frontier: Interoperability or Infrastructure?

Today, Africa has more than 500 million registered mobile money accounts, according to the GSMA. But fragmentation remains a massive hurdle. In many countries, a user on MTN cannot send money directly to a customer on Airtel Tigo without extra steps, higher costs, or even physical cashouts.

Incubator or Accelerator? The Choice That Could Shape Your Startup’s Future

Too often, the two terms get used interchangeably. But in reality, they serve very different purposes in a founder’s journey. For African entrepreneurs navigating fragmented markets, scarce capital, and limited networks, knowing which one to choose can be the difference between a stalled dream and a growth story.

Where Will Your First Million Come From? Funding Pathways for Startups in Emerging Markets

Where banks won’t lend, microfinance institutions (MFIs) step in. Africa is home to over 400 MFIs serving more than 40 million people. They’ve long been the backbone of Africa’s informal economy, providing small loans to farmers, market women and gig workers.

The Startup Blueprint for Emerging Markets: From Idea to Launch

Engaging accelerators, incubators, and trade associations connects startups to mentors, funding, and new customers. Networking at industry events amplifies visibility and fosters cross-sector collaboration

10 Bold Investment Ideas Sparked by the Sierra Leone Diaspora Investment Conference

Sierra Leone, like many emerging markets across Africa, sits at the crux of change, where digital transformation, infrastructure gaps, food security, climate resilience, and a rising entrepreneurial class intersect. That convergence creates rare opportunities for investors ready to build systems that are inclusive, future-proof, and rooted in local strength.

Reflections from the Sierra Leone Diaspora Investment Conference: My Top Five Takeaways

As co-host, I challenged every attendee to do more than just listen. I asked each of us to make at least one meaningful connection in the room. Why? Because when like-minded individuals come together with shared intentions, the possibilities are endless. We weren’t just guests in a room, we were stakeholders in Sierra Leone’s future.

Fintech for the Informal Economy: Designing Products That Truly Fit

The so-called informal economy is Africa’s economic backbone accounting for 80–90% of jobs and up to 65% of GDP in Sub-Saharan Africa (Fintech Insider Africa). From street vendors and market hawkers to gig workers and smallholder farmers, these entrepreneurs operate outside traditional banking systems, relying instead on flexible, trust-based tools.

For fintech, this is both a challenge and an opportunity. Success doesn’t come from copying legacy banking models that have already failed this sector it comes from designing products around local realities, cultural norms, and economic behavior.

This means building for USSD, agent networks, and pay-as-you-go flows; using alternative data for credit; digitizing savings groups; and embedding financial tools directly into daily workflows. Done right, fintech can unlock trust, scale, and lasting impact meeting people where they earn, trade, and thrive.